Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). Web =pv (rate, nper, pmt, [fv], [type]) open present value.xlsx and go to the pv workbook, or type what's in the screen capture below in your own spreadsheet,. Ad enjoy great deals and discounts on an array of products from various brands. All future cash flows must be discounted to the present using. Web examples of present value formula (with excel template) let’s take an example to understand the present value’s calculation better.

The big difference between pv and npv is that npv takes into account the initial investment. Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment goal. Present value is discounted future cash flows. Web this present value or pv calculator consist of three worksheets. Net present value is the difference between pv of cash flows and pv of cash outflows.

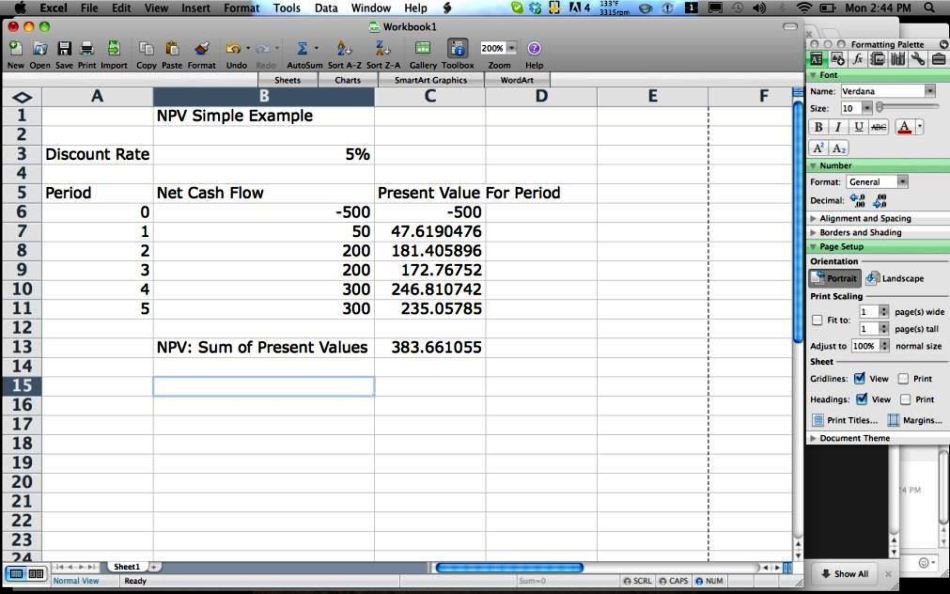

You can use excel to calculate npv instead of figuring it manually. Web in simple terms, npv can be defined as the present value of future cash flows less the initial investment cost: Web pv = fv / (1 + r) where: Learn new skills with a range of books on computers & internet available at great prices. Web up to 50% cash back let's walk through an example of using the excel pmt function in wps for a monthly loan payment calculation.

Web this present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. Net present value is the difference between pv of cash flows and pv of cash outflows. Here is a screenshot of the net. If you want to calculate the present value of a single investment that. Ad enjoy great deals and discounts on an array of products from various brands. I = interest rate per period in decimal form. Web =pv (rate, nper, pmt, [fv], [type]) open present value.xlsx and go to the pv workbook, or type what's in the screen capture below in your own spreadsheet,. Present value of a single cash flow. Web up to 50% cash back let's walk through an example of using the excel pmt function in wps for a monthly loan payment calculation. Web the present value formula. All future cash flows must be discounted to the present using. The first worksheet is used to calculate present value based on interest rate, period and yearly payment. You can use excel to calculate npv instead of figuring it manually. It is used to determine the. Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment goal.

Present Value Is Discounted Future Cash Flows.

Web present value calculator itself will help you to calculate the exact value of the future investment as if it existed in the present day. Web the present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now. The big difference between pv and npv is that npv takes into account the initial investment. Web pv = fv / (1 + r) where:

Web In Simple Terms, Npv Can Be Defined As The Present Value Of Future Cash Flows Less The Initial Investment Cost:

Present value of a single cash flow. Pv = fv (1 + i)n p v = f v ( 1 + i) n. Web examples of present value formula (with excel template) let’s take an example to understand the present value’s calculation better. Web npv is an essential tool for corporate budgeting.

An Npv Of Zero Or Higher Forecasts.

Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). You can use excel to calculate npv instead of figuring it manually. Web =pv (rate, nper, pmt, [fv], [type]) open present value.xlsx and go to the pv workbook, or type what's in the screen capture below in your own spreadsheet,. It is used to determine the.

Web The Net Present Value (Npv) Of An Investment Is The Present Value Of Its Future Cash Inflows Minus The Present Value Of The Cash Outflows.

Thanks to this formula, you can estimate the present value of an income. Use the excel formula coach to find the. Ad embarkwithus.com has been visited by 10k+ users in the past month Web this present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments.